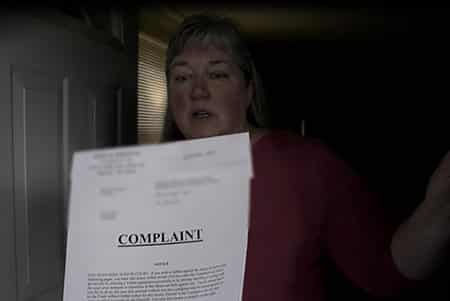

The pandemic has caused financial turmoil for many people. Many Pennsylvanians find themselves behind on payments whether it be on their credit cards, personal loans, medical bills, or with their mortgage company. As Pennsylvania re-opens and recovers from the pandemic, creditors will continue collection efforts to take advantage of consumers who have found themselves hurting… Continue reading Entering a Voluntary Payment Plan with Your Creditor After Being Served with a Lawsuit May Not Be Your Best Solution

Entering a Voluntary Payment Plan with Your Creditor After Being Served with a Lawsuit May Not Be Your Best Solution